S&P 500 rises to another record, even as rally leader Apple snaps 5-day winning streak

The S&P 500 and Nasdaq Composite rose to all-time highs on Tuesday, continuing their blistering rally off the March lows even amid a mixed batch of economic data and a rare decline by market leader Apple.

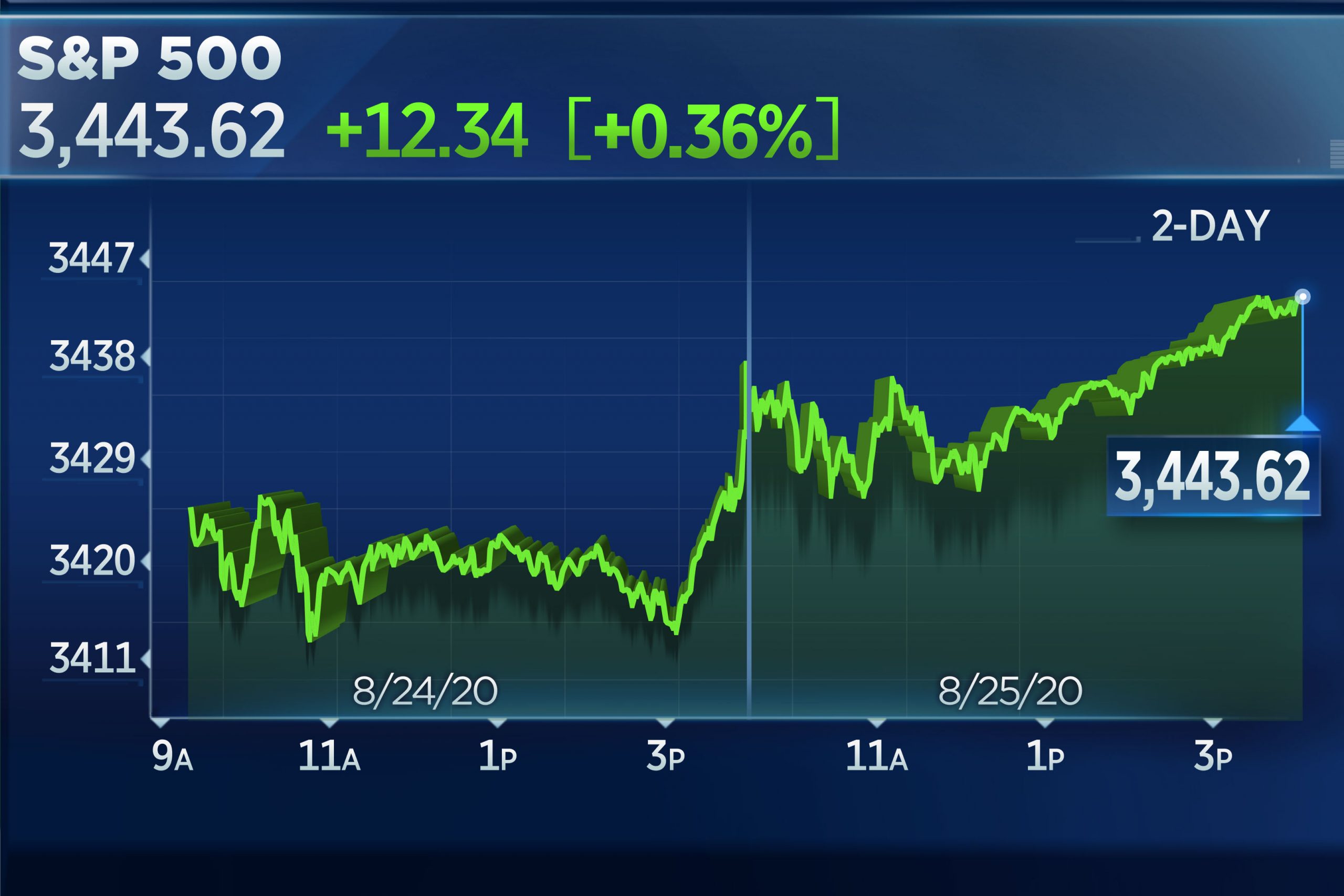

The broader market index closed 0.4% higher at 3,443.62. The tech-heavy Nasdaq advanced 0.8% to 11,466.47. Facebook climbed more than 3% to lead both benchmarks higher. Amazon, Alphabet and Microsoft were all up more than 1%.

Earlier on Tuesday, U.S. Census reported a 36% surge in sales of newly built homes in July. However, the Conference Board’s consumer confidence index fell for a second straight month.

Traders work during the closing bell at the New York Stock Exchange (NYSE) on March 17, 2020 at Wall Street in New York City.

Johannes Eisele | AFP | Getty Images

Tuesday’s gains put the S&P 500 and Nasdaq up 57% and 72%, respectively, since hitting intraday lows on March 23. Recent gains have been driven in part by a decline in daily U.S. coronavirus cases.

The number of newly confirmed coronavirus infections in the U.S. has dropped. Data compiled by Johns Hopkins University showed new cases fell to around 38,000 and have been below 50,000 since mid-August.

“Equity investors continue to express cautious optimism on the direction of the economy and progress with the virus,” said Mark Hackett, chief of investment research at Nationwide. “Investor sentiment has shifted, with substantial optimism now embedded into the equity markets, driving valuations to the highest level since the technology bubble.”

Meanwhile, the Food and Drug Administration approved the use of convalescent plasma as a treatment for coronavirus patients. The Trump administration is also reportedly considering fast-tracking an experimental vaccine from the U.K.

Market sentiment got a boost after U.S.-China trade talks resumed.

In a statement, the Office of the U.S. Trade Representative said that both sides made “progress and are committed to taking the steps necessary to ensure the success of the” phase one trade deal. The two countries also “addressed steps that China has taken to effectuate structural changes called for by the Agreement that will ensure greater protection for intellectual property rights,” the statement said. Tensions between both countries have increased recently, with the U.S. criticizing China’s handling of the coronavirus outbreak within its borders.

Tech has contributed the lion’s share of the gains off the March lows. However, this heavy concentration has some investors worried about the stability of this rally.

“We’re telling some of our clients to utilize these rallies in the markets as good opportunities to trim some of your equity exposure,” said Alex Chalekian, CEO of Lake Avenue Financial, noting that most of the S&P 500 is still negative year to date.

Dow struggles amid Apple decline, average shake-up

The Dow Jones Industrial Average fell on Tuesday as Apple shares declined for the first time in six sessions and traders assessed a big shake-up for the average.

The 30-stock Dow dropped 60.02 points, or 0.2%, to close at 28,248.44 and snapped a three-day winning streak. Apple pulled back by 0.8%, giving back some of its blistering rally into a record valuation. Boeing also contributed to the Dow’s decline, falling 2%.

On Monday, S&P Dow Jones Indices announcing that Salesforce.com, Amgen and Honeywell will replace Exxon Mobil, Pfizer and Raytheon Technologies within the average. The changes are driven by Apple’s coming stock split, which will reduce the technology weighting in the price-weighted average.

Salesforce, Amgen and Honeywell gained while Exxon Mobil, Pfizer and Raytheon declined. Exxon has been a part of the average for nearly 100 years.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.