Global gold production to grow 2.5% by 2029 – report

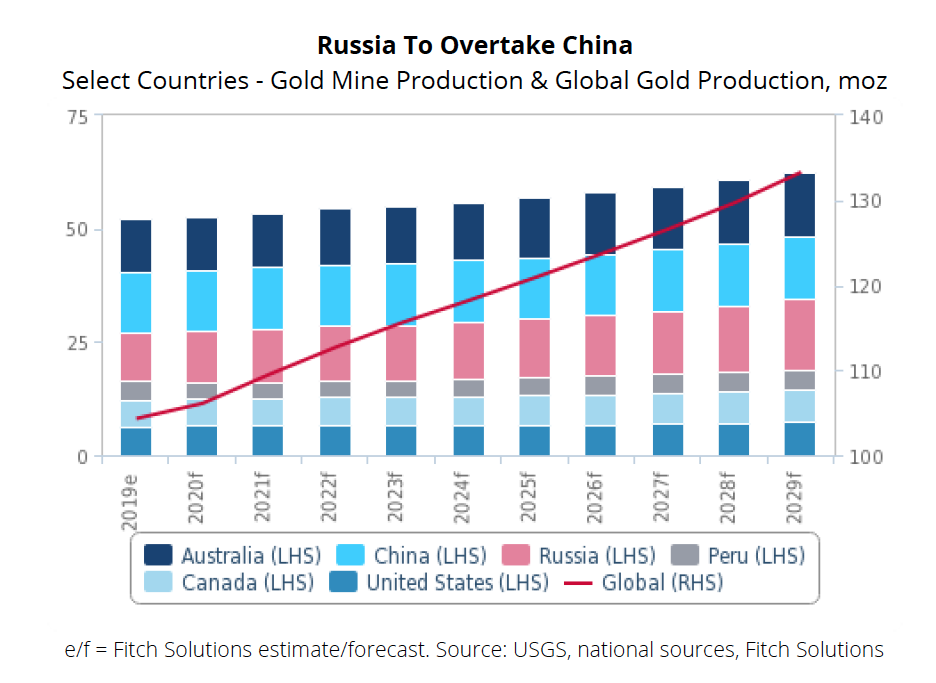

In the market analyst’s view, Russian gold production will lead the rise with gold output jumping from 11.3moz in 2020 to 15.5moz in 2029. This figure represents an average annual growth of 3.7% during 2020-2029 and would see Russia overtake China as the largest gold miner, accounting for 11.6% of global output by 2029, compared with 10.6% in 2020.

Russia’s growth is being driven by ongoing and expanding US sanctions because the rising risk of state banks being frozen out of dealing in US dollar-denominated assets as bilateral relations remain strained is pushing the Russian central bank to increase its holdings of gold.

However, Fitch says that in the longer term, Russian gold production will be underpinned by at least 21 new mining projects due to come online. At the forefront of this trend is Polyus Gold, whose Natalka project achieved full production in 2019 and has a production capacity of 420-470koz per annum. At the same time, the company is developing the Sukhoi Log, one of the largest untapped goldfields with a potential annual output of 1.7moz.

China’s gold production, on the other hand, is expected to remain roughly stagnant in the next 10 years, with an average annual growth rate of 0.2%, a notable slowdown compared with the average annual growth of 3.1% over the previous decade.

Fitch’s review states that these results are the product of stricter environmental regulations, particularly those around solid waste from gold prospecting, which led to a wave of gold mine closures and output declines in major producing provinces, including Shandong, Jiangxi and Hunan.

Years of intensive gold mining also plays a role in the deceleration, as the activity has resulted in falling reserves and production halts in several areas, including Qinghai and Gansu.

On the other hand, major Chinese firms are expected to ramp up investment in foreign gold mines, as the country’s gold demand growth far outpaces that of production. As an example of this, Fitch highlights Shandong Gold’s purchase of a 50% stake in the Veladero mine in Argentina from Barrick Gold for $960 million.

Australia and the US

Australia is expected to see modest production growth over the coming years, supported by a strong project pipeline, rising gold prices and competitive operating costs.

Production Down Under is posed to increase from 11.7moz in 2020 to 14.2moz by 2029, averaging 2.2% annual growth.

OZ Minerals is the company on top of the curve, as it continues to develop its A$916 million Carrapateena copper-gold project, one of the largest mines being built in Australia.

Carrapateena was commissioned in Q4 2019, after which the project will ramp up to steady state production. The mine will be a 4.25mnt per annum copper-gold underground operation, with an estimated life of 20 years. Life of mine average annual production is expected to be 65kt of copper and 67koz of gold.

Finally, Fitch’s report states that the US gold mining sector will continue to attract significant investment activity supported by the country’s history of exploration and known precious metal deposits. Nevada in particular will remain a key location for exploration and development, with both Barrick and Newmont Goldcorp committed to several large-scale projects in the state.

Among these projects are Barrick’s flagship Goldrush project near Cortez, which offers proven and probable reserves of 8.7moz.

At the same time, the world’s second-largest gold producer together with Newmont Corporation – the No. 1 – is building a third shaft at the Turquoise Ridge mine near Winnemucca, which is forecast to increase annual production to more than 500koz a year by 2023.

Barrick is also working with Premier Gold Mines at South Arturo and it expects production to increase in Q419 following the completion of construction activities of Phase 1 open pit and El Niño underground mine.